Scandal Rocks Nigerian Oil Sector: Ex-NNPCL Chief's Bank Accounts Frozen in Fraud Probe

- by Muhammed, Abuja, RNG247

- about 4 months ago

- 217 views

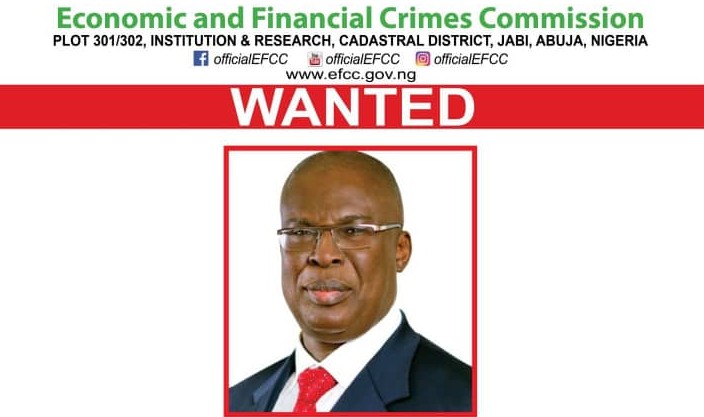

In a stunning development that has sent shockwaves through Nigeria's oil industry, a Federal High Court in Abuja has ordered the freezing of four bank accounts linked to Mele Kyari, the former Group Managing Director of the Nigerian National Petroleum Company Limited (NNPCL). This action comes as part of an ongoing investigation into allegations of conspiracy, abuse of office, and money laundering.

Justice Emeka Nwite issued the order on Wednesday, granting the request made by the Economic and Financial Crimes Commission (EFCC) in an ex-parte motion. The frozen accounts, all held at Jaiz Bank, contain a staggering sum of over 661 million naira, which investigators suspect to be proceeds of unlawful activities.

The EFCC's investigation was sparked by a petition filed in April by the Guardian of Democracy and Rule of Law, a watchdog organization. According to court documents, the anti-graft agency's preliminary findings suggest that Kyari may have exploited his position to facilitate contracts and launder illicit funds.

Amin Abdullahi, an EFCC investigator, revealed that the accounts under scrutiny were managed by Kyari's family members, who are believed to be acting as fronts. The transactions in these accounts were allegedly disguised as payments for a book launch and activities of a non-governmental organization.

The court order, which is temporary pending further investigation, affects four specific accounts:

1. Account number 0017922724, named Mele Kyari

2. Another account also numbered 0017922724, named Mele Kyari

3. Account number 0018575055, under Guwori Community Dev. Fnd

4. Account number 0018575141, for Guwori Community Development Foundation Flood Relief

This development marks a significant turn in the ongoing efforts to combat corruption within Nigeria's crucial oil sector. The NNPCL, as the state-owned oil company, plays a pivotal role in the nation's economy, and allegations of misconduct at its highest levels have far-reaching implications.

As the investigation continues, the EFCC has indicated that it is awaiting further documentation from Jaiz Bank and has already issued a 72-hour no-debit instruction on the accounts in question.

The court has adjourned the matter until September 23 for a progress report, leaving many to wonder what further revelations may come to light in this high-profile case. As Nigeria grapples with ongoing challenges in its oil industry, this latest scandal underscores the urgent need for transparency and accountability at all levels of management.

The nation now watches with bated breath as this story unfolds, potentially reshaping the landscape of Nigeria's most vital economic sector.

.jpg)

0 Comment(s)